Careers

You may have seen one of our ads that made you want to research our reputation. Or perhaps the circumstances at your current lender have changed to the point of evaluating your options. Whatever your reason, you took the next logical step and landed here to discover why Province Mortgage Associates has excelled in creating an atmosphere where mortgage professionals thrive. From our award-winning culture to our client-acclaimed Province Mobile App, we are proud to have refined a way of life in the mortgage business that is uncommonly authentic. Are you interested in buying local, working local, and selling local at a company that cares deeply about your brand and your success? Let’s have a conversation. Call Alan Conley today!

Alan Conley – Strategic Growth Manager

aconley@provincemortgage.com | (401) 787-6779

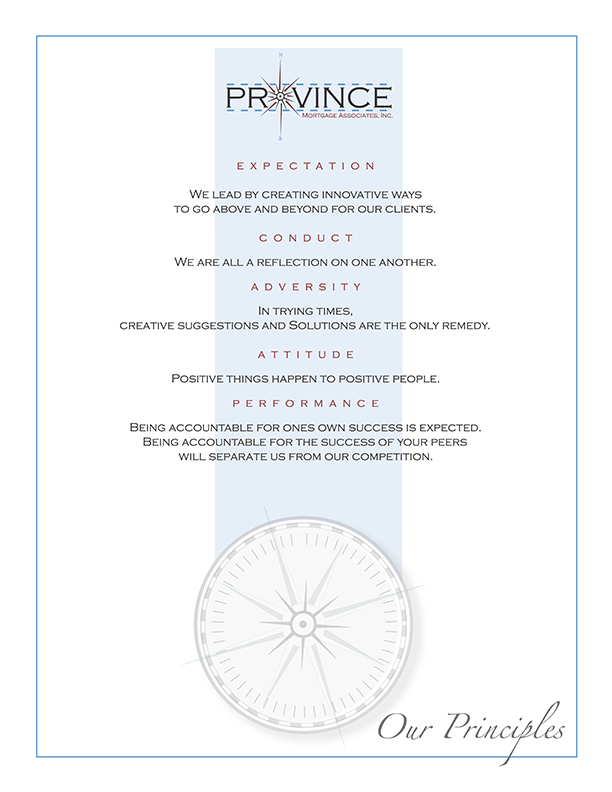

Our Principles

Working at Province Mortgage: A Staff Perspective

What is it like to work at Province Mortgage Associates? Hear it from our very own!